New York Market Overview

Office:

In the depth of the pandemic last year, a majority of New York City office tenants facing lease expirations did not want to commit to a long-term deal. Instead, they opted for shorter extensions. The number of short-term renewals, a deal shorter than five years, was up 46% in 2020 compared to the year before.Almost 20% of Manhattan office space is up for rent, up to about 80 million square feet of space either unrented or for sublet.

About a third of commercial leases are to expire in the next three years. Only a fifth of workers are back in the office, with many likely to never fully return. Amid the glut, rents could dip more than 20% from year’s end 2019.

The short-term renewal trend has started to shift in recent months as the pandemic waned and various restrictions were lifted. The share of short-term deals among all renewals dropped to 32% in the period from January to May, this year.

One of the biggest hurdles for landlords is transportation. Over 80% of companies reported that employee perceptions of mass transit, namely personal safety, are an obstacle to returning to work.

The real estate industry has brought back more workers to the office than any other industry, with 70% of employees back. That’s far more than the 14% share of the next highest industry, financial services. Real estate employers project 90% of employees to return by July 2021 and almost all to return by September.

Financial services companies project 61% of employees will be back by the end of September. Tech employers expect 40% to return at that point, down from the 51% estimate made in March.

Larger employers have brought back more employees at a slower pace. At companies with more than 5,000 employees only 8% have returned, while 24% have returned to the office among employers with fewer than 500 employees.

Goldman Sachs set a date for its employees to start returning to their desks, and JPMorgan is bringing staff back in early July. UBS Bank still plans to have only six desks for every 10 employees. Hybrid work models pose a long-term threat to office landlords, as their tenants may opt for less space when they renew leases.

WeWork’s office occupancy rate recovered to 53% at the end of May, up from 47% late last year, though still well below its pre-pandemic norm of 70 to 80%.

The city’s office market, battered during the pandemic, is showing signs of a rebound. Companies are taking their spaces off the sublease market, in anticipation of an earlier than expected return to the workplace.

More than 15 million square feet of sublet inventory has been dumped on Manhattan’s office market since the beginning of the pandemic.

The surge of sublease additions slowed in the first quarter of 2021, as more Americans got vaccinated and infection levels fell.

In Midtown South, 880,000 square feet of sublease space was added in the fourth quarter of 2020, just under 300,000 square feet was added in the first quarter of this year.

On average, sublets are offered for about 25% less than direct leases, and average sublet asking rents decreased a further 4.9% in the first quarter compared to a year ago.

With more than half of all adults fully vaccinated, Americans are once again eating at their favorite restaurants, attending concerts and flying. The majority of office workers have yet to return to the office. Nationally, just under one-third of office workers have returned to the office spaces they occupied before the pandemic.

The owners are trying to negotiate a path forward with its new lender. Moin Development is in talks with Eyal Ofer’s Global Holdings Group to work out a solution to its debt at NoMad’s Mondrian hotel.

Coinbase is opening its first New York City office. Fresh off its IPO, the cryptocurrency exchange platform has inked a 30,000-square-foot sublease at 55 Hudson Yards.

The pandemic hit the commercial real estate market hard. Property tax bills now reveal just how hard. New York City expects property tax revenue to drop by $1.6 billion, or 5% in the coming fiscal year.

New additions of sublease space slowed to 800,000 square feet in May, the smallest figure since availability started shooting up in June of last year.

Hotels in New York City are slowly rising from the pandemic, but their road to recovery looks longer and harder than in other metro areas. Across the city, the occupancy rate for hotels that are open was 58.7% for the week ending May 29. The slow pace of recovery poses a problem for over-leveraged hotels. About 38% of New York hotels with loans in commercial-mortgage backed securities were 30 days or more past due in May. The occupancy rates across the nation will return to pre-pandemic levels by 2023, but it could take two years longer in New York.

Retail:

Asking retail rents have plunged for vacant retail spaces among the 17 major shopping corridors in Manhattan. Since the meltdown in 2015, the average asking rent has declined between 50% and 68%.Online stores have continued to diminish sales in brick and mortar retail stores.

In the past 12 months, asking rents fell in 16 of the 17 shopping corridors.

Landlords are offering hefty improvement allowances, including free rent, flexibility on renewal, and other incentives and inducements.

Retailers looking to open or expand stores have ample options of available spaces, lower leasing costs and may be able to use the prior tenant's improvements.

The pandemic has not visibly altered the meltdown in retail rents that is now in its seventh year.

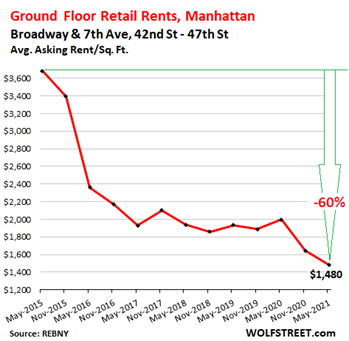

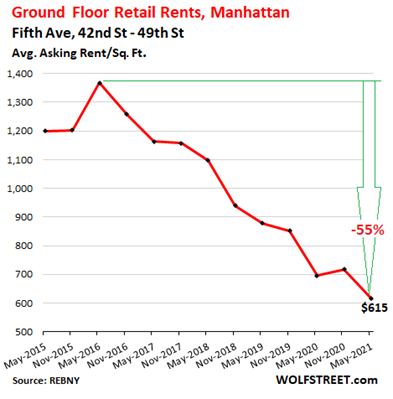

Midtown:

Midtown retail average asking rent in the spring of 2021 collapsed by 60% from the peak in 2015. Yet, rent is still $1,480 per square foot per year.Year-over-year, the average Midtown retail asking rent plunged 26%.

Fifth Avenue, from 42nd Street to 49th Street, the average asking rent dropped by 11% year-over-year, and 55% from the peak in 2016, to $615 per square foot per year.

Fifth Avenue from 49th to 59th Street, the average asking rent, on a year-over-year basis, ticked down only 1%, after a big jump this Spring, to $3,000/sf, and was down 18% from 2015.

Midtown South:

On West 34th Street between Fifth Avenue and Seventh Avenue, the average asking rent ticked up this Spring to $488/sf, but was still down 4% year-over-year, and 51% from 2015.

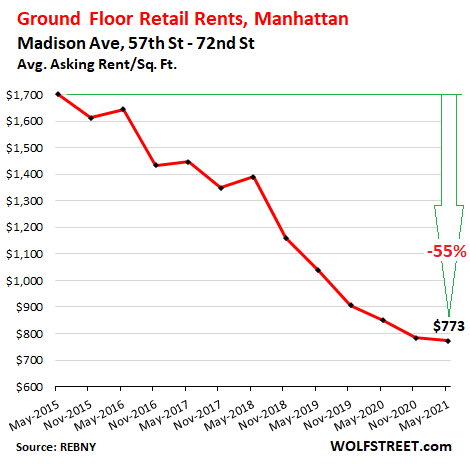

Madison Avenue:

Madison Avenue, between 57th Street and 72nd Street, the average asking rent fell by 9% year-over-year, to $773/sf, and was down 55% from 2015.

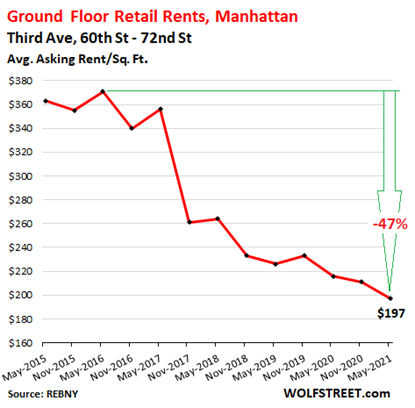

Third Avenue, between 60th and 72nd Street, the average asking rent fell 9% year-over-year, to $197/sf, and 47% from the peak in 2016.

Downtown:

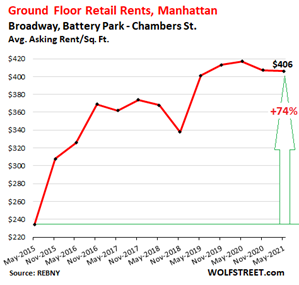

Downtown retail on Broadway, between Battery Park and Chambers, the average asking rent rose 74% from 2015 through Spring 2020. But over the past 12 months, it backed off it's all-time high, and ticked down 3% to $406/sf.

On Broadway between Houston and Broome, the average asking rent collapsed by 37% year-over-year and by 68% from the peak in 2015.

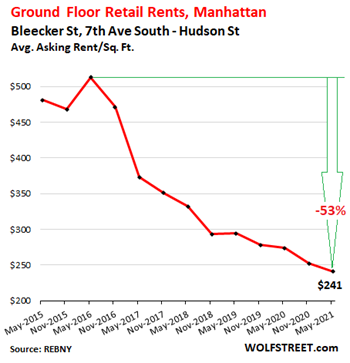

On Bleecker Street, between 7th Avenue and Hudson, the asking rent fell 12% year-over-year and 53% from the peak in 2016.

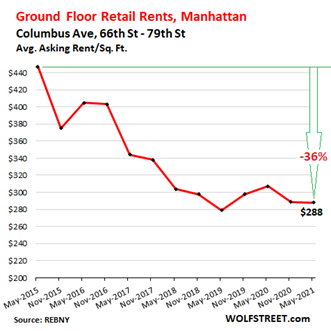

Upper West Side:

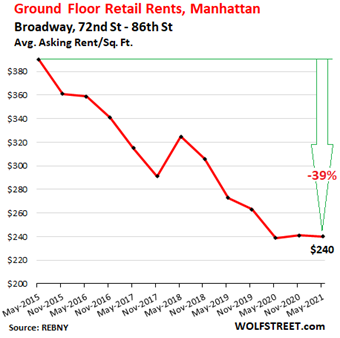

On Broadway, between 72nd Street and 86th Street, the average asking rent was flat for the year and down 39% from 2015.

On Columbus Avenue, between 66th Street and 79th Street, the average asking rent fell 6% year-over-year and was down 36% from 2015.